All Categories

Featured

Table of Contents

You can add these to a supply portfolio to get some direct exposure to property without the initiative of located or vesting bargains. Historically returns have been really good with REITs yet there is no promise or guarantee and they will go up and down in value swiftly. Right here are some benefits and drawbacks of REITs: REITs are very liquid financial investments because they are traded on stock market, allowing capitalists to get or offer shares any time they desire.

REITs go through substantial regulatory oversight, including reporting requirements and compliance with specific revenue circulation rules. This level of law gives transparency and capitalist defense, making it a fairly risk-free choice to prevent fraudulence or untrustworthy drivers. Historically, REITs have delivered competitive returns, frequently equivalent to or also going beyond those of stocks and bonds.

Accredited Investor Real Estate Partnerships

REITs are structured to be tax-efficient (Commercial Real Estate for Accredited Investors). As an entity, they are exempt from federal income taxes as long as they distribute at the very least 90% of their taxable earnings to investors. This can lead to potentially higher returns and beneficial tax treatment for financiers. While REITs can give diversity, several purchase industrial buildings, which can be prone to financial slumps and market changes.

Workplace and multifamily REITs could be facing significant disturbance in the coming year with elevated interest rates and reduced need for the possession. I have said lots of times the next opportunity is most likely industrial property since those are the possessions that have one of the most room to drop.

Who offers flexible Accredited Investor Real Estate Income Opportunities options?

You will certainly never ever find out about these unless you know a person that understands a person who is entailed. Comparable to a REIT, these are swimming pools of money used to get property. Right here are some advantages and drawbacks of a private actual estate fund: Personal property funds can potentially supply greater returns compared to openly traded REITs, and other choices, due to the fact that they have the flexibility to spend straight in residential properties with the purpose of making the most of revenues.

Purchasing a personal fund grants you accessibility to a diversified portfolio of property possessions. This diversity can assist spread out danger throughout different building kinds and geographic areas. There are lots of actual estate funds that either emphasis on household realty or have property property as part of the overall portfolio.

Fund managers are generally specialists in the real estate market. Due to the fact that they do this complete time, they are able to situate far better offers than the majority of part-time active capitalists.

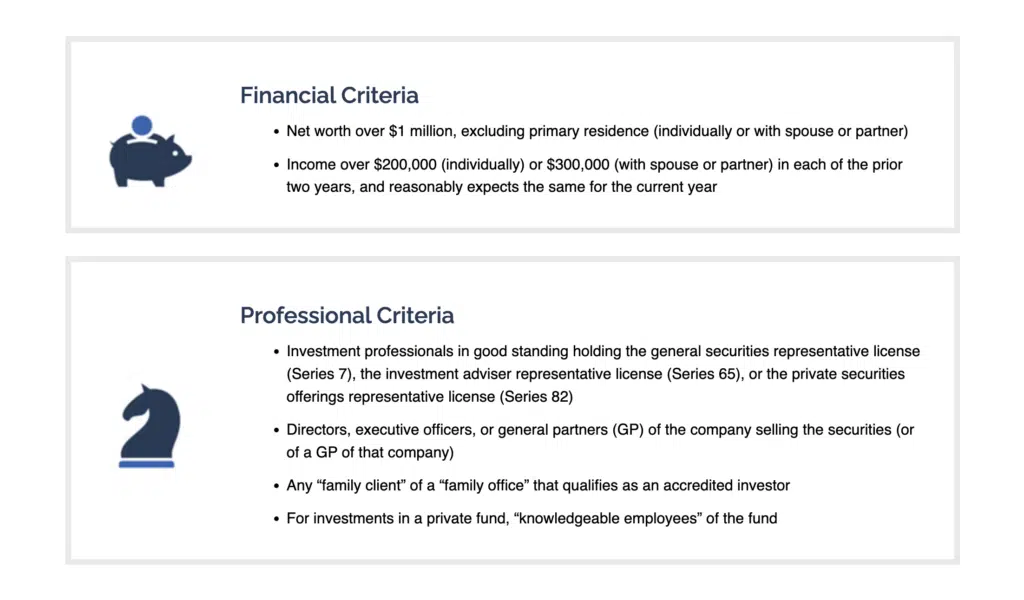

These investments are restricted to recognized investors only. The interpretation of a recognized capitalist is a little bit wider than this but as a whole to be certified you need to have a $1 million total assets, aside from your primary home, or make $200,000 as a solitary tax payer or $300,000 with a partner or partner for the previous two years.

The distinction is a fund is commonly bought a number of jobs while syndication is typically limited to one. House syndications have been extremely prominent in the last few years. Below are some advantages and downsides of a syndication: One of the key benefits of many realty submissions is that financiers might have a say in the property's administration and decision-making.

Where can I find affordable Accredited Investor Real Estate Platforms opportunities?

Effective submissions can yield considerable profits, particularly when the home appreciates in worth or creates consistent rental earnings. Investors can benefit from the building's economic performance. I have actually made returns of over 100% in some submissions I spent in. Submissions can be extremely conscious modifications in rate of interest. When rate of interest rise, it can increase the expense of funding for the property, possibly influencing returns and the overall stability of the financial investment.

The success of a submission greatly depends on the know-how and honesty of the driver or enroller. Recent situations of fraud in the submission area have actually raised worries concerning the dependability of some operators. There are a handful of significant examples however none smaller than the recent Grant Cardon allegations.

Leaving a syndication can be challenging if it is also possible. If it is permitted, it normally requires finding another capitalist to acquire your risk otherwise you might be compelled to wait till the home is offered or re-financed. With very rare exemptions, these investments are scheduled for certified investors only.

This is purchasing a swimming pool of cash that is used to make finances versus real estate (Real Estate Development Opportunities for Accredited Investors). As opposed to possessing the physical property and undergoing that possible drawback, a home mortgage fund only purchases the paper and makes use of the realty to protect the financial investment in a worst-case situation

They create revenue through passion settlements on home mortgages, supplying a foreseeable capital to capitalists. Payments are available in no matter a renter remaining in area or rental performance. The asset does not decline if real estate values drop, thinking there is no default, because the possession is a note with a promise of repayment.

This enables for stable regular monthly settlements to the investors. Unlike private funds and syndications, home mortgage funds commonly supply liquidity options.

How do I exit my Real Estate Crowdfunding For Accredited Investors investment?

It is not as liquid as a REIT however you can obtain your financial investment back if needed. Maybe the most significant advantage to a mortgage fund is that it plays a critical duty in improving neighborhood areas. Home mortgage funds do this by giving lendings to actual estate financiers for residential property recovery and development.

The one prospective downside is that you may be giving up on prospective returns by purchasing a stable possession. If you are okay taking losses and intend to bet for the greater return, among the various other fund choices might be a far better fit. If you are looking for some stable diversity a mortgage fund may be an excellent enhancement to your profile.

How does Exclusive Real Estate Crowdfunding Platforms For Accredited Investors work for high-net-worth individuals?

The Securities and Exchange Commission (SEC) has certain regulations that capitalists require to fulfill, and frequently non accredited financiers don't meet these. For those who do, there is a chance to spend in startups. Crowdfunding platforms currently supply non recognized financiers the chance to purchase equity of startups easily, by bypassing the SEC guidelines and having the ability to attach a reduced upfront resources amount.

Table of Contents

Latest Posts

Tax Lien Listings

Homes For Sale Back Taxes

Real Estate Tax Sale Law

More

Latest Posts

Tax Lien Listings

Homes For Sale Back Taxes

Real Estate Tax Sale Law